|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Complete Guide to No Closing Cost Cash Out Refinance OptionsConsidering a no closing cost cash out refinance can be an attractive option for homeowners looking to tap into their home equity. This guide explores what you need to know, how it works, and what to expect. Understanding No Closing Cost Cash Out RefinanceA no closing cost cash out refinance allows you to replace your existing mortgage with a new one that has a higher balance, providing you with extra cash. The key feature is that you don't pay the closing costs upfront. How Does It Work?

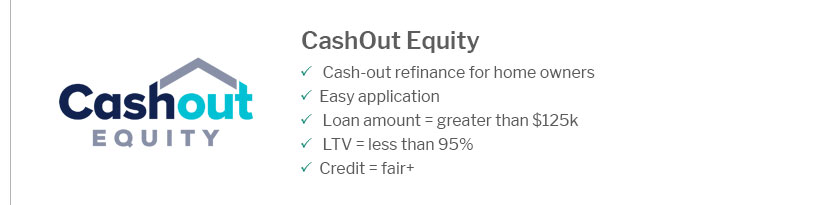

Pros and ConsPros: Access to cash, no upfront closing costs, potential tax benefits. Cons: Higher interest rates, increased loan balance, potential long-term costs. When to Consider This OptionHomeowners often consider this option when they need funds for major expenses such as home improvements or debt consolidation. It can also be a strategic move if you anticipate a rise in home value, allowing you to refinance after home value increases for better terms. Qualifying for a No Closing Cost Cash Out RefinanceCredit Score and EquityTypically, lenders require a good credit score and a significant amount of home equity. The higher your equity, the better the terms you might receive. Debt-to-Income RatioYour debt-to-income ratio should be within acceptable limits to ensure you can handle the new loan payments comfortably. Comparing Lenders and OffersIt's crucial to compare different lenders to find the best deal. Some might offer lower interest rates, while others might provide more favorable terms. Research and Negotiation

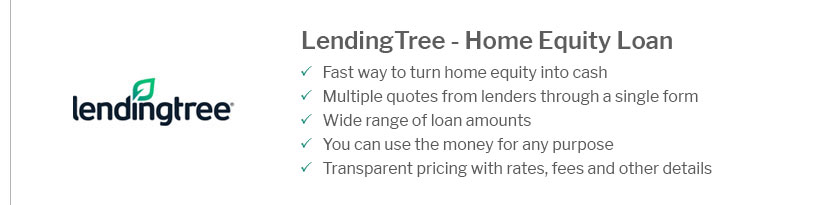

Alternatives to No Closing Cost Cash Out RefinanceIf this option doesn't suit your needs, you might consider alternatives such as a home equity loan or line of credit. Additionally, if you've recently faced financial difficulties, you might explore how to refinance home after bankruptcy to improve your financial standing. FAQ

https://www.investopedia.com/no-closing-cost-refinance-explained-5192742

A no-closing-cost refinance allows homeowners to roll the closing costs into their new mortgage, rather than paying them out of pocket. When considering a no- ... https://money.usnews.com/loans/mortgages/articles/the-true-cost-of-a-no-cost-mortgage-refinance

Key Takeaways - A "no-closing-cost refinance" has closing costs. You just pay them over time instead of up front. - A refinance with no closing ... https://www.bankrate.com/mortgages/is-no-closing-cost-for-you/

A no-closing-cost refinance gets rid of the need to pay refinancing fees upfront, but it's not free. Instead, you'll finance the closing ...

|

|---|